“For every Goldman Sachs, there were a hundred small dealers in commercial paper in the late 19th century who never lasted longer than 10 years”

1869 was a significant year in American history for several reasons:

- Black men were granted the right to vote

- The Wyoming Territory extended voting rights to women

- Work began on the Brooklyn Bridge in New York

- The transcontinental railroad was completed, linking the nation from coast to coast

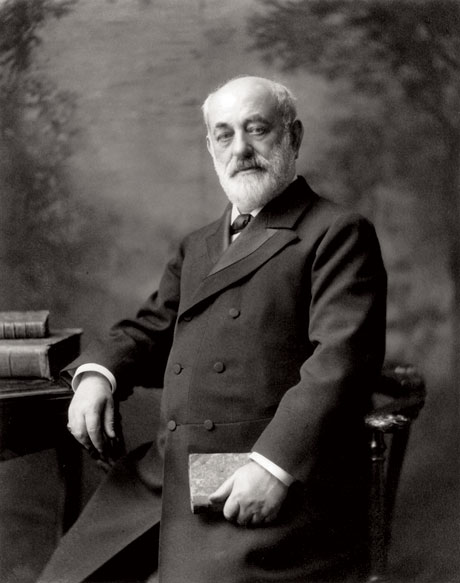

All these developments marked the birth of America as a world power, presenting numerous opportunities; opportunities a 48 year old German Jewish immigrant called Marcus Goldman wanted to capitalize on.

Coming to America as a refugee in 1848, Marcus Goldman was determined to make a better life for himself and his family. Post-civil war America presented multiple opportunities, particularly on Wall Street in New York, and Goldman was determined to participate. In 1869, he and his family moved from Philadelphia to “the Big Apple” in search of a better life.

With no prior finance experience, Goldman opened “M. Goldman, Banker & Broker”. He bough promissory notes from merchants at a discount and sold them to uptown bankers for a profit. Just like the Goldman Sachs we see today, Goldman’s firm’s success, depended on the success of his clients. He built a reputation doing this for about a decade, growing the firm as a family business. At around this time was when he incorporated the Sachs family, bringing in Samuel Sachs, his son in law. A few years later, his son Henry was incorporated, beginning the dynasty of co-ownership that would establish the firm as a force on Wall Street.

As brothers in law, the pair led the firm in what could be described as a “balanced” way; Henry Goldman more adventurous, and Sam Sachs more conservative. Together, they engineered GS becoming one of the largest commercial paper dealers in America.

Goldman wanted to expand the business beyond commercial paper, and he sought to get into the lucrative business of underwriting. At the time, the industry was dominated by some powerful banks, like J.P. Morgan, who did underwriting for the railroads, one of the most profitable businesses at the time. When GS tried to get in on this trade, the gatekeepers at the time basically shunned them away, which really upset Henry Goldman.

Rather than deciding to take them on, Goldman turned his energy towards what would become a revolutionary shift in American investment banking – underwriting for retail businesses. Along with the Lehman Brothers (who filed for bankruptcy in 2008), they took on what was an immense risk at the time. Most successful public firms were the railroad companies, ordinary companies weren’t seen in that light, as they are now. They didn’t have big balance sheets that would normally attract investors. Goldman took companies like Sears and F.W. Woolworth public, and these turned out to be huge successes.

Additionally, another Henry Goldman innovation was linking the value of a company to its earnings, rather than just its capital assets. This was the first price-to-earnings ratio of its kind, that is still used when valuing companies today. They also got in on the foreign exchange market.

Marcus Goldman died in 1904, aged 82. He left behind a legacy perhaps even he couldn’t imagine.

At the turn of the century, Goldman Sachs had the earned the respect of Wall Street they wanted, and this set the tone of the firm for decades to come.

Full video: